By Muchee News Investigative Team

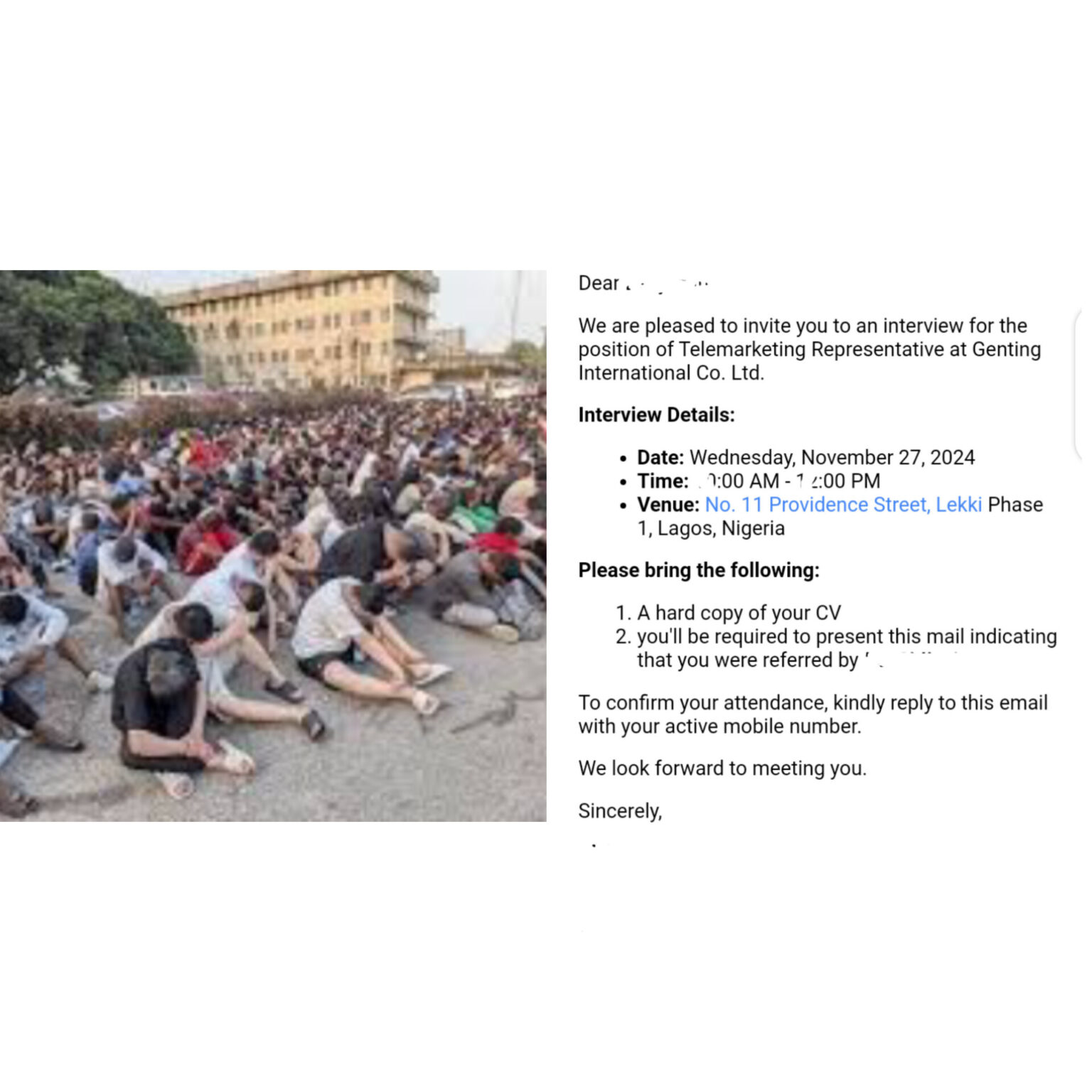

In a shocking revelation, Muchee News has uncovered the operations of a massive crypto fraud syndicate posing as “Genting International Company” in Lagos. The company, which set up offices in Victoria Island and Lekki, operated for six months before being raided by the Economic and Financial Crimes Commission (EFCC). In what is being called one of the largest financial crime crackdowns in Nigeria, 729 suspects were arrested.

A Global Scam: Insights from Muchee News Investigations

According to Muchee News investigations, the syndicate used a global network of brokers who provided access to thousands of potential victims. The fraudsters primarily targeted U.S. citizens, using Telegram as their platform of choice to communicate with victims and execute their scams.

Victims were lured with promises of earning $20 in USDT (a popular cryptocurrency), Bitcoin wallet credits, or cash transfers through PayPal, Cash App, Coinbase, and other platforms. Once trust was established, the syndicate manipulated victims into sharing sensitive financial information or making investments that would never yield returns.

Further revelations by Muchee News show that the scam was orchestrated under the supervision of foreign nationals, primarily Chinese and a smaller number of Indians, raising serious questions about how they operated in Nigeria with apparent ease and confidence.

Over 10,000 U.S. Citizens Scammed

The Muchee News investigative team estimates that over 10,000 U.S. citizens fell victim to the scheme, suffering financial losses that could run into millions of dollars. Many victims believed they were engaging with a legitimate international investment firm due to the syndicate’s polished online presence and convincing communications.

One U.S. victim shared their experience with Muchee News: “They promised me quick returns and even credited a small amount to my Bitcoin wallet initially to build trust. I eventually lost over $60,000 before realizing I’d been scammed.”

Why Nigeria? A Safe Haven for Fraud?

The discovery of foreign nationals supervising this fraudulent operation has raised significant concerns about Nigeria’s reputation as a hub for financial crime. The question remains: Is Nigeria becoming a home for fraud?

Nigeria’s growing association with cybercrime is worrisome, especially as foreign criminals now appear to view the country as a safe base for their activities. Weak regulations, delayed prosecution, and economic challenges may have created an environment that emboldens criminals to set up operations in the country.

A cybersecurity expert consulted by Muchee News commented, “The fact that foreign operatives can confidently run fraudulent enterprises in Nigeria reflects a systemic problem. It’s not just about enforcement but also about perception. Nigeria must work harder to rebuild trust on the global stage.”

EFCC’s Role in the Crackdown

While Muchee News broke the story, the EFCC acted swiftly to raid the syndicate’s premises, arresting 729 individuals and seizing critical evidence. Sources close to the investigation revealed that the operation had been under surveillance following reports from international agencies.

“This raid is a major victory in the fight against cybercrime,” an EFCC source told Muchee News. “However, it also highlights the need for greater vigilance and stricter regulations to prevent such schemes from taking root in the first place.”

The Technology Behind the Scam

The fraudsters used a mix of advanced technology, including block chain manipulation and nano-tech tools, to execute their operations. Telegram served as a hub for managing communications and coordinating scams, further complicating efforts to track and shut down their activities.

The Impact on Victims

Victims of this scheme were left devastated, with many losing their life savings. The promise of high returns on cryptocurrency investments was a key tactic used to exploit individuals unfamiliar with the nuances of digital assets.

Muchee News investigations found that victims included retirees, small business owners, and young professionals looking to diversify their portfolios. “I thought I was being smart by investing in crypto,” one victim admitted. “Instead, I lost everything I had saved for my retirement.”

What Must Change?

The revelations from Muchee News point to a larger issue: Why are foreign nationals flocking to Nigeria to perpetrate fraud with such confidence? The answer lies in the systemic challenges Nigeria faces, including gaps in enforcement, economic instability, and inadequate regulatory oversight.

Moving forward, there is a pressing need for Nigeria to implement stricter regulations, improve cybersecurity infrastructure, and work closely with international agencies to combat transnational financial crimes.

Muchee News will continue to monitor this developing story and provide updates as new details emerge.

For more investigative reports, visit www.mucheenews.com.